No matter what’s on your calendar, we offer several Virtual summits on every month that allow you to take advantage of specialist insights on a variety of tax and compliance topics. Our packages included one to four hours and a full day session. You can select which packages make the most benefits for you. Our course is Accredited by NASBA and the IRS

The annual subscription gives you full access to select many Live Virtual Summits! The package is available for 12 months, and you will have the opportunity to Live Q&A session with speaker and Case Studies!

With the increasing complexity and ever-changing nature of tax laws and issues, today’s Accountant, CPA and Tax professional needs an update course focusing on the hottest Federal tax topics that emphasis of newly enacted tax compliance.

Topics Covered:

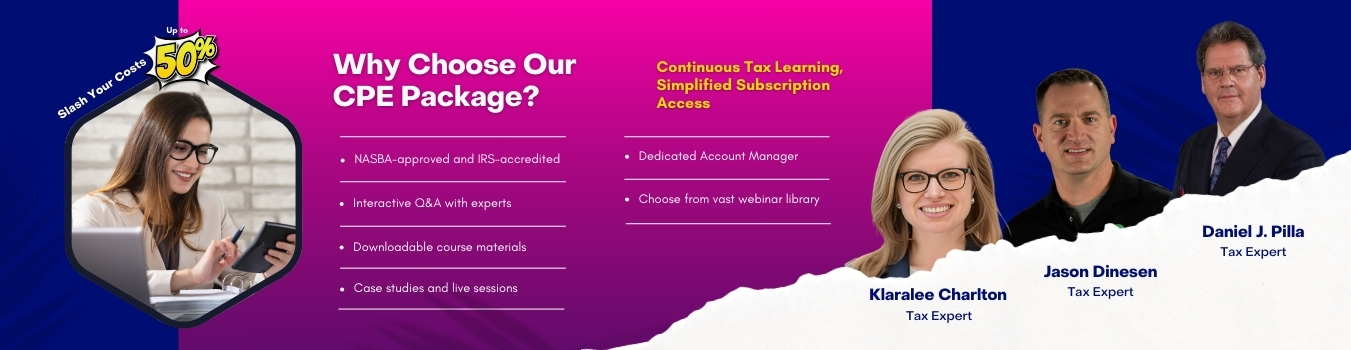

Why Choose CPE Package?

What not Include: